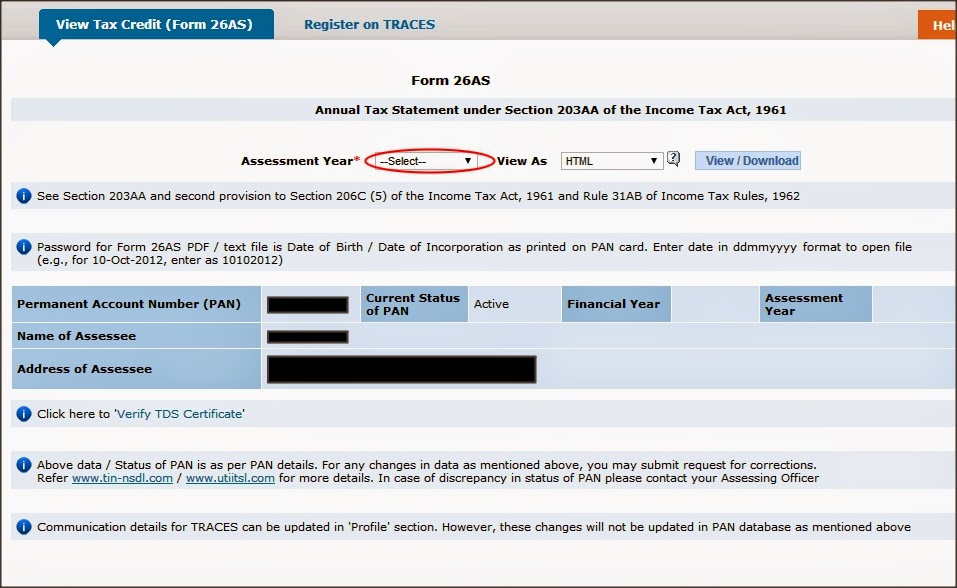

My Self-Assessment / Advance Tax in my Annual Tax Credit Statement (26AS) do not reflect the amounts deposited by me. Information relating to pending and completed proceedingsĢ.Information relating to demand and refund.

Details of Tax Deducted on sale of immovable property u/s194IA (in case of seller of such property).Details of any Specified Financial Transactions (SFT) (if any).Refund received during a financial year (if any).Advance Tax / Self-Assessment Tax / Regular Assessment Tax deposited.It contains the details of the following: It is a consolidated Annual Information Statement for a particular Financial Year (FY). Central & State Government Department/Approved Undertaking Agency.

0 kommentar(er)

0 kommentar(er)